NEW: McDonald’s CEO Chris Kempczinski whines on CNBC that Trump’s ‘No Tax On Tips’ policy isn’t fair to his company because they don’t allow their employees to get tips.“The issue with no tax on tips is it only benefited those restaurants that have tips.”Sounds like a personal problem.

Related Posts

BREAKING OUT OF DC: A fire just erupted inside the underground Capitol trolley system that connects the U.S. Capitol !!

A fire reportedly broke out inside the underground Capitol trolley system that connects the U.S. Capitol to the Rayburn House Office Building, triggering a rapid emergency response…

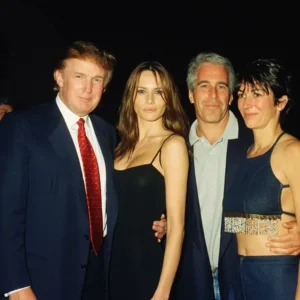

Ghislaine Maxwell Dropped New Detail About Big Bill Clinton During DOJ Interview

Earlier this year, Ghislaine Maxwell revealed a previously unreported detail about former President Bill Clinton’s interactions with the late convicted sex offender Jeffrey Epstein.According to testimony transcripts…

Jeffrey Epstein’s brother makes serious claim about why Donald Trump now wants to release the files

Jeffrey Epstein’s brother, Mark Epstein, has made new allegations regarding former President Donald Trump and the forthcoming release of documents related to his late brother’s case. Mark…

BREAKING: The Supreme Court just handed President Trump the immigration equivalent of a nuclear button !!

In a closely divided 5–4 decision, the fictional U.S. Supreme Court has ruled that President Trump may invoke the 1798 Alien Enemies Act to classify the Venezuelan…

JUST IN: Top Senators Urge Military To Defy Trump Administration

A group of high-profile lawmakers in the fictional Republic released a striking video statement calling on members of the nation’s military to resist what they characterized as…

NEW: Prominent Democrat Steps Away From Harvard Gig Over Epstein Ties

Former U.S. Treasury Secretary Larry Summers announced Wednesday that he would be stepping away from his teaching role at Harvard University as administrators probe his links to…